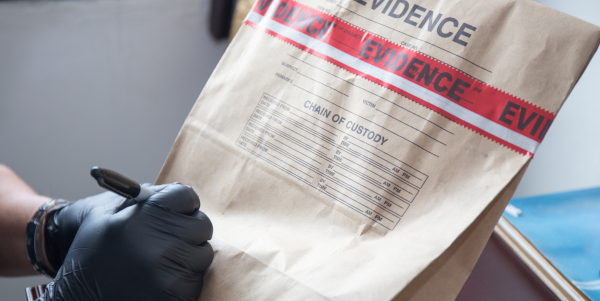

The Status of Independent Contractor is Changing

By Trent Cotney, Cotney Attorneys and Consultants.

New changes to worker classification are making it a challenge to classify subcontractors and 1099 labor.

On December 27, 2021, in The Atlanta Opera, Inc. 371 NLRB No. 45 (2021), the National Labor Relations Board provided public notice requesting briefs and analysis on whether the definition and test used to determine independent contractor status. This request aligns with the Biden Administration's push to move toward the California ABC Test for worker classification, making it more difficult for contractors to classify workers as subcontractors or 1099 labor.

The notice requested that interested parties answer the following questions:

1 - Should the NLRB follow the existing definition of the term "independent contractor" as contained in SuperShuttle DFW, Inc., 367 NLRB No. 75 (2019)? The SuperShuttle decision relied on various common law factors to measure the degree of independence and control of independent contractors.

2 - If SuperShuttle should not be followed, what standard should replace it? Should the NLRB follow FedEx Home Delivery, 361 NLRB 610, 611 (2014)? The FedEx decision focused on the economic realities of whether an independent contractor-operated and existed outside of the prime employer. In proposed legislation such as the Protect the Right to Organize (PRO) Act, the California ABC test takes center stage in determining whether an independent contractor is classified correctly.

The California ABC test considers a worker an employee and not an independent contractor unless the primary employer meets all three of the following:

-

The worker is free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract for the performance of the work and in fact;

-

The worker performs work that is outside the usual course of the hiring entity's business; and

-

The worker is customarily engaged in an independently established trade, occupation, or business of the same nature as that involved in the work performed.

See https://www.labor.ca.gov/employmentstatus/abctest/

Parties and amici (friends of the court) may file briefs not exceeding 20 pages in length with the NLRB on or before February 10, 2022. We anticipate that the NLRB and Biden Administration will use this as an opportunity to move toward the ABC test, given its proclivity to support the standard in past legislation.

Learn more about Cotney Attorneys and Consultants in their RoofersCoffeeShop® Directory or visit www.cotneycl.com.

Disclaimer: The information contained in this article is for general educational information only. This information does not constitute legal advice, is not intended to constitute legal advice, nor should it be relied upon as legal advice for your specific factual pattern or situation.

Comments

Leave a Reply

Have an account? Login to leave a comment!

Sign In